// Stands at the forefront of investment banking services

// About

Your Partner for Expert Guidance

Your Partner for Expert Guidance

in Mergers & Acquisitions and Capital Raising

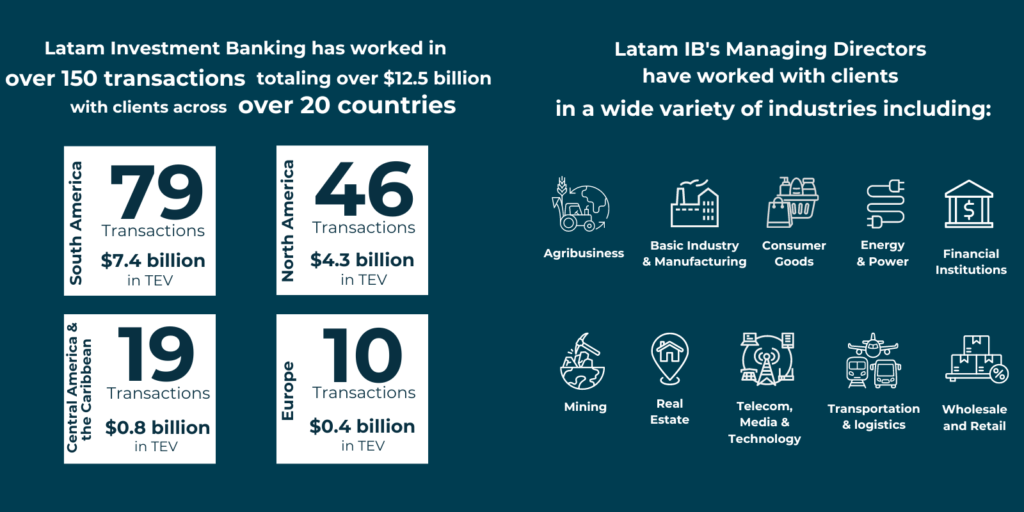

Welcome to Latam Investment Banking, your premier strategic partner in corporate finance and investment banking across the Americas. Specializing in cross-border mergers & acquisitions and capital raising, we offer unparalleled expertise in navigating the complex financial landscapes of the United States, Latin America, and the Caribbean.

Empowering businesses in the Americas with value-added mergers & acquisitions and capital raising services, guided by our core values of trust, expertise, and continuous support.

With our team’s extensive background, Latam Investment Banking is exceptionally positioned as a trusted advisor to United States, Latin America and Caribbean owners and entrepreneurs. We adeptly navigate the distinctive challenges encountered by companies operating within the Americas.

// why choose us

Comprehensive Investment Banking Solutions

Comprehensive Investment Banking Solutions

for Your Success

01

Expertise in Cross-Border Transactions

Specializing in cross-border mergers & acquisitions and capital raising, we offer unparalleled expertise in navigating the complex financial landscapes of the United States, Latin America, and the Caribbean.

Learn More

02

Elevating Business Success in the Americas

Empowering businesses in the Americas with highest mergers & acquisitions and capital raising services, guided by our core values of trust, expertise, and continuous support.

Learn More

// OUR TEAM

Senior Bankers

Our Managing Directors are prominent figures in the field of investment banking, boasting extensive expertise in the industry.